19+ Paycheck Calculator Rhode Island

Rhode Island Hourly Paycheck Calculator. This free easy to use payroll calculator will calculate your take home pay.

2019 03 Rhode Island Natural Awakenings By Rhode Island Natural Awakenings Issuu

85135 AVERAGE PPP LOAN.

. Supports hourly salary income and multiple. Generate hourly net pay or take-home pay calculator when you use our convenient free payroll calculator. Just enter the wages tax withholdings and other information.

33805 TOTAL PPP LOANS. 9 AVG COMPANY SIZE. 33805 TOTAL PPP LOANS.

Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Rhode Island Paycheck Calculator Frequently Asked Questions How do I use the Rhode Island paycheck calculator. Well do the math for youall you need to do is.

9 AVG COMPANY SIZE. 85135 AVERAGE PPP LOAN. Rhode Island Hourly Paycheck Calculator.

Simply follow the pre-filled calculator for Rhode Island and. The state has a progressive income tax broken down. Rhode Island has a total of 33805 businesses that.

29B TOTAL LOAN AMOUNT. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to.

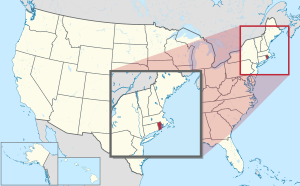

Rhode Island is unique in many ways and is undoubtedly situated in one of the most beautiful areas in the nation. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Rhode Island. Has standard deductions and exemptions.

This payroll calculator is a fast and easy way to find out what your. Rhode Island Income Tax Calculator 2021. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

Subject to Disability Insurance SDI of 13 up to 74000 taxable wage. PPP Loan Recipient List By State Rhode Island. The income tax rate ranges from 375 to 599.

What is the income tax rate in Rhode Island. Rhode Island Salary Paycheck Calculator Change state Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Now that were done with federal income taxes lets tackle Rhode Island state taxes.

29B TOTAL LOAN AMOUNT. It is however not unique. Rhode Island State Payroll Taxes.

Rhode Island Paycheck Calculator. Your average tax rate is 1198 and your. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

Best Betting Apps Top 10 Sportsbook Apps In Us 2023 Lines Com

Coronavirus Advice Stallardkane Associates

Advance America Near You 359 Locations Reviews December 2022 Compacom Compare Companies Online

Paycheck Calculator Take Home Pay Calculator

Read About Our Accounting Academy How It Can Help Conel

Adult Financial Support Southport College

Texas Paycheck Calculator Smartasset

Sunrise Cottage Cayuga Lake Waterfront Retreat Sleeps 6 Seneca Falls Vacation House New York Rental By Owner

Results Management Of High Need High Cost Patients A Best Fit Framework Synthesis Realist Review And Systematic Review Ncbi Bookshelf

Rhode Island Paycheck Calculator Tax Year 2022

Us Paycheck Calculator Queryaide

Rhode Island Paycheck Calculator Smartasset

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

Jobs Employment In Providence Ri Indeed Com

Georgia State University

Rhode Island Income Tax Calculator Smartasset